Following examining the above mentioned characteristics, we arranged our suggestions by most effective for adaptable financing, financing from the large lender, secured financing and financing for startups.

Remember to overview the applicable privateness and safety policies and conditions and terms for the web site you're viewing.

As opposed to cash-movement borrowers, organizations ought to file every month or weekly reports within the position from the assets used given that the borrowing base

The biggest downside is significant banking companies have Considerably increased application standards than most online lenders. As an example, Virtually all financial institutions have to have your business to become at the very least two a long time outdated and only take credit scores more than seven hundred. When your business can meet up with those sorts of skills, by all indicates, get your business line of credit from a traditional financial institution.

Brief-phrase business loans are generally based on your own business's credit record and fiscal wellbeing. They generally involve collateral and have set repayment schedules.

The most significant drawback is always that Backd doesn't fund all industries. Some industries Backd won't operate with include things like fiscal products and services, housing expert services, government or non-revenue agencies, cannabis, and Grownup leisure to call some.

Equipment loans Have a very nifty aspect developed into them that decreases chance to both equally the lender and the borrower, which subsequently implies much better fees and terms on regular.

Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Accelerated depreciation has its rewards, but that doesn’t indicate it’s the only option for your personal business.

As a substitute to an equipment loan, you could opt for an equipment lease. Equipment leases have smaller month-to-month payments and may not demand a down payment like an equipment loan could. What happens at the end of site web your lease relies on the kind of lease you indication.

Check out extra personalized loan resourcesPre-qualify for a private loanCompare major lendersPersonal loan reviewsPersonal loan calculatorHow to qualifyHow to consolidate credit card debtAverage particular loan interest rates

That overall flexibility is perfect for you being a business proprietor — nevertheless it’s also why lenders wish to be careful to who they extend credit lines.

Lendio is our favorite supply for business lines of credit. So why does Lendio deserve the very best spot? Straightforward — mainly because Lendio is not a lender, but a lending marketplace.

Following your application is permitted, it may take 3 to five business days to put in place your account and begin getting funding.

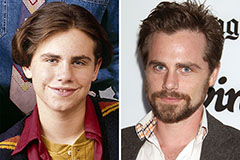

Rider Strong Then & Now!

Rider Strong Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Kane Then & Now!

Kane Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!